Now more than ever, manufacturers, distributors, and providers are concerned about their cash flow needs. Learn how partnering with an inventory finance or commercial finance vendor can provide financial flexibility and a competitive advantage.

What is inventory finance?

In the healthcare sector, inventory finance is a line of credit established between a medical manufacturer or distributor and a healthcare provider or dealer to purchase the manufacturer’s products for later sale or use. Healthcare manufacturers may choose to partner with a commercial finance vendor to develop extended payment terms for healthcare providers to offer financial flexibility and protect their cash flow. Inventory finance can be used to pay for a wide range of products—anything from defibrillators to prosthetics to implants to consumables and supplies.

How does inventory finance work?

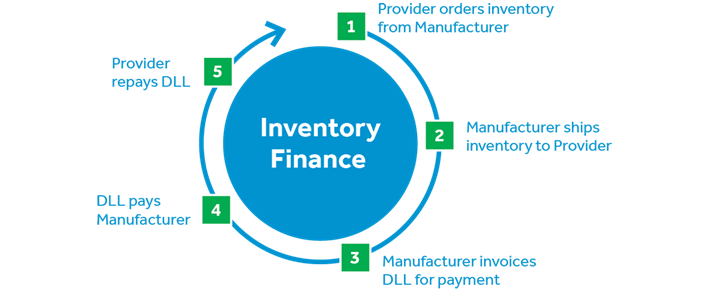

When a manufacturer or distributor partners with a commercial finance vendor, healthcare providers will place orders through the manufacturer or distributor who will ship the product to the provider directly.

The commercial finance vendor will pay the manufacturer or distributor on behalf of the healthcare provider. Depending on the agreed terms, the manufacturer or distributor can expect to receive payment in as soon as a few business days. The commercial finance vendor will invoice the provider, and the provider will pay the commercial finance vendor based on the agreed upon payment terms.

What are the benefits of inventory finance to healthcare manufacturers and distributors?

- Helps inbound cash flow. A manufacturer does not have to wait for a long time to receive payment for its goods. With some vendors, the manufacturer can be paid as soon as three days after it invoices the commercial finance vendor.

- Offers a competitive advantage. Just like manufacturers and distributors, healthcare providers may also be concerned with their cash flow. Providers can take advantage of extended payment terms by choosing to order from a manufacturer that has an inventory finance option. This can help strengthen relationships between a manufacturer and a provider.

- Increases purchasing power. In many cases, a commercial finance vendor may be able to offer healthcare providers a larger line of credit than a manufacturer can. A provider will be able to purchase more equipment at one time, so a manufacturer may see higher profits and be able to move products faster to dealers and healthcare providers.

- Offloads billing and credit functions and transfers risk. By removing this burden, a manufacturer may have additional time to focus on other areas, like product development, marketing, or sales.

What are the benefits of inventory finance to healthcare providers?

- Extends payment terms. Longer, interest-free payment terms are available than those from a bank or manufacturer. So rather than 30 days, the provider might have 45, 60, or even longer to repay for the manufacturer’s products.

- Protects cash flow. Programs between a commercial finance vendor and a healthcare manufacturer or distributor are developed to match a provider’s cash flow cycle. Placing an order on a commercial finance vendor’s line of credit reduces the impact on a provider’s cash. And the extended terms offer the provider the opportunity to collect payments prior to having to repay the outstanding invoice(s).

- Increases purchasing power. Larger lines of credit are available, enabling the provider to place larger orders, anticipate future growth and needs, and offer patients a selection of products.

What should a healthcare manufacturer or distributor look for in a commercial finance partner?

Healthcare manufacturers or distributors that want to offer providers an inventory finance solution should look for a vendor that offers customized solutions tailored to their needs. Consider working with industry-specific experts who will understand a business’ products, sales cycle, challenges, and goals.

Vendors with easy-to-use online portals can offer manufacturers, distributors, and providers reporting functionality and transparency. Like a mobile banking app, users can have 24/7 access from any device to information pertaining to their credit line, like recent transactions and their credit availability. Manufacturers can even use this as a sales reporting tool to gain insight on what products providers are ordering the most and what is available in stock.

Lastly, manufacturers and distributors should look for a vendor who will partner with them for the future, are interested in their long-term success, and will help them navigate changing markets.

With 50 years of experience, DLL understands the unique needs of our partners around the world—and offers proven solutions to help businesses thrive.